Market Insight – April 2024

The recent escalation of the current Middle East conflict has sharpened the focus of credit market participants on geopolitical risks and what it might mean for valuations and spreads. In this note, we consider the recent history of USD credit markets, how they have responded to geopolitical risks relative to financial markets risks, and how these risks are reflected in the Invesco SOFR Academy Across-The-Curve Credit Spread Index (AXI) and the Invesco SOFR Academy Financial Conditions Credit Spread Index (FXI).

Notably, recent events in the Middle East have not had much impact on the US fixed income markets – at least not yet. Over the past month, US treasury yields have moved higher, the opposite of a typical flight to quality response. Indeed, as we write this on April 16, 10-year treasury yields are at their highest level in nearly six-months. Nor have credit spreads widened much, as they might be expected to when confronted with rising risk. In fact, the average credit spread on the Bloomberg US Aggregate index (LBUSTRUU Index) is about 18bp lower than it was six-months prior. Again, no flight to safety is evident here.

None of this is to say that US bond markets can’t grow more reactive to headline risk. But a look at credit market performance in the post-pandemic times shows markets and economic conditions remain more sensitive to bank and financial credit issues than they are to geopolitical risk and other sources.

“FXI tends to be more responsive to changes in actual market conditions than mark-to-model alternatives. ”– Alex Roever, CFA, Senior Advisor, SOFR Academy

To help quantify recent credit market responses to stress we have constructed two comparisons of credit market indicators in this post-pandemic era, which we define as since December 2021 up to April 2024. During this time several events have triggered stress in the USD credit markets. These events include:

- the Invasion of Ukraine

- the beginning of the cryptocurrency crisis

- the bankruptcy of FTX

- the US regional bank crisis

- the onset of the Israel-Hamas conflict

- the Iranian missile attack on Israel

This set of events provides anecdotal evidence of the impact of both geopolitical and financial market stress on US credit markets. To gauge market response, we assembled two data comparisons using several indicators and consider how they reacted to various events.

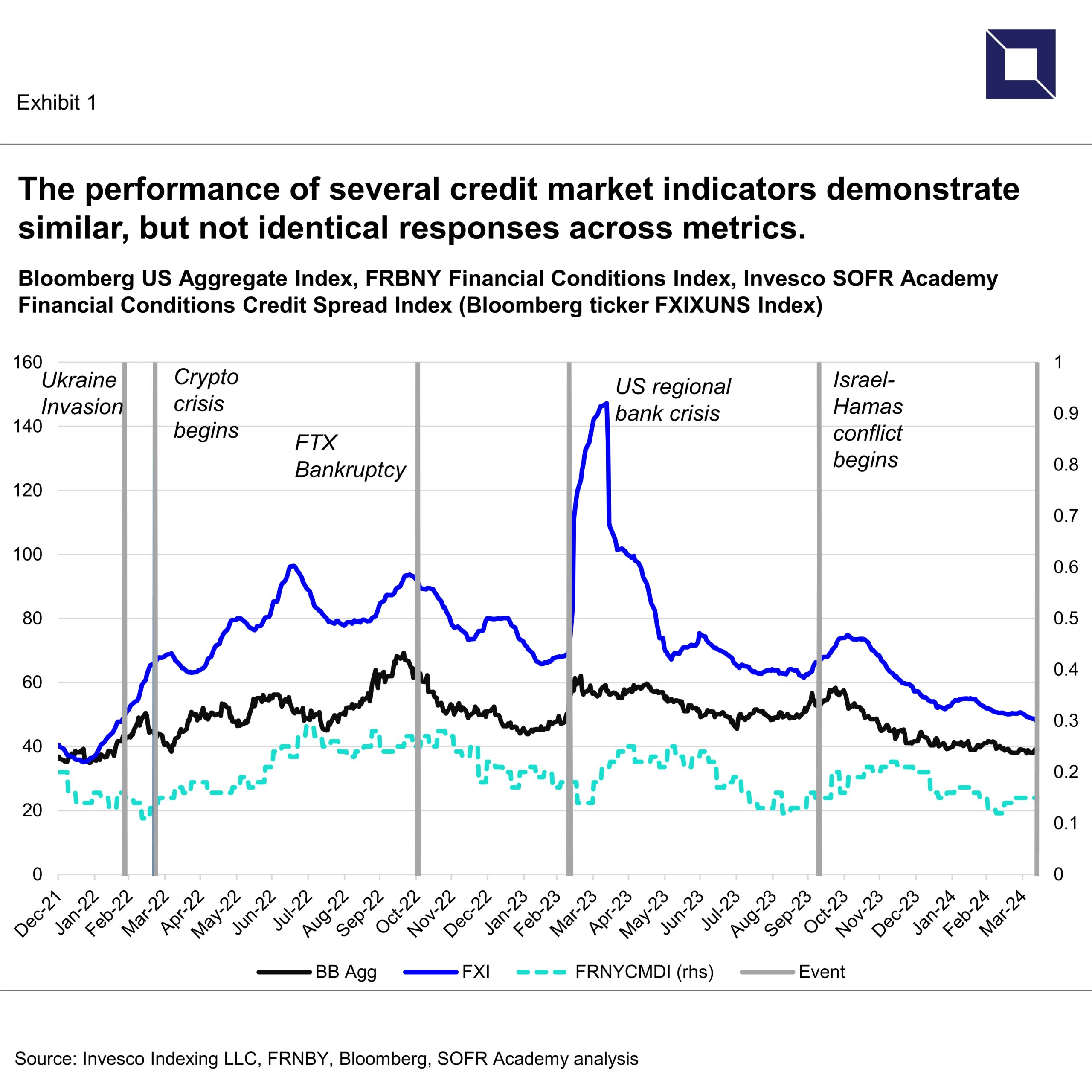

Exhibit 1 recaps the performance of several credit market indicators including:

- The average spread (OAS) of the Bloomberg US Aggregate Index, a widely followed index covering all major US FI classes (Bloomberg ticker LBUSTRUU Index);

- The Federal Reserve Bank of New York (FRBNY) Financial Conditions Index, to reflect relative tightening or easing of economic conditions in response to various events (Bloomberg ticker FRNYCMDI Index); and

- The Invesco SOFR Academy Financial Conditions Credit Spread Index (Bloomberg ticker FXIXUNS Index). FXI is a broad-based corporate credit index constructed from actual trades on US corporate bonds with maturities from overnight to five years.

The data shown in Exhibit 1 demonstrate similar, but not identical responses across these metrics. The difference between the Bloomberg Aggregate and FXI is notable because of FXI’s greater sensitivity to events. This behavior makes sense given that the Aggregate index includes non-credit asset classes including US Treasuries and Agency MBS which tend to attract assets during times of credit stress. Because FXI is based exclusively on investment grade credit it is a cleaner measure of credit stress.

Another aspect of FXI that adds to its value as a market metric is that its levels are determined by actual trades of its underlying securities and not by mark to model levels of the entire portfolio. As a result, FXI tends to be more responsive to changes in actual market conditions than mark-to-model alternatives. This is most evident during the US regional bank crisis in 2023 where changes in funding conditions were quickly reflected.

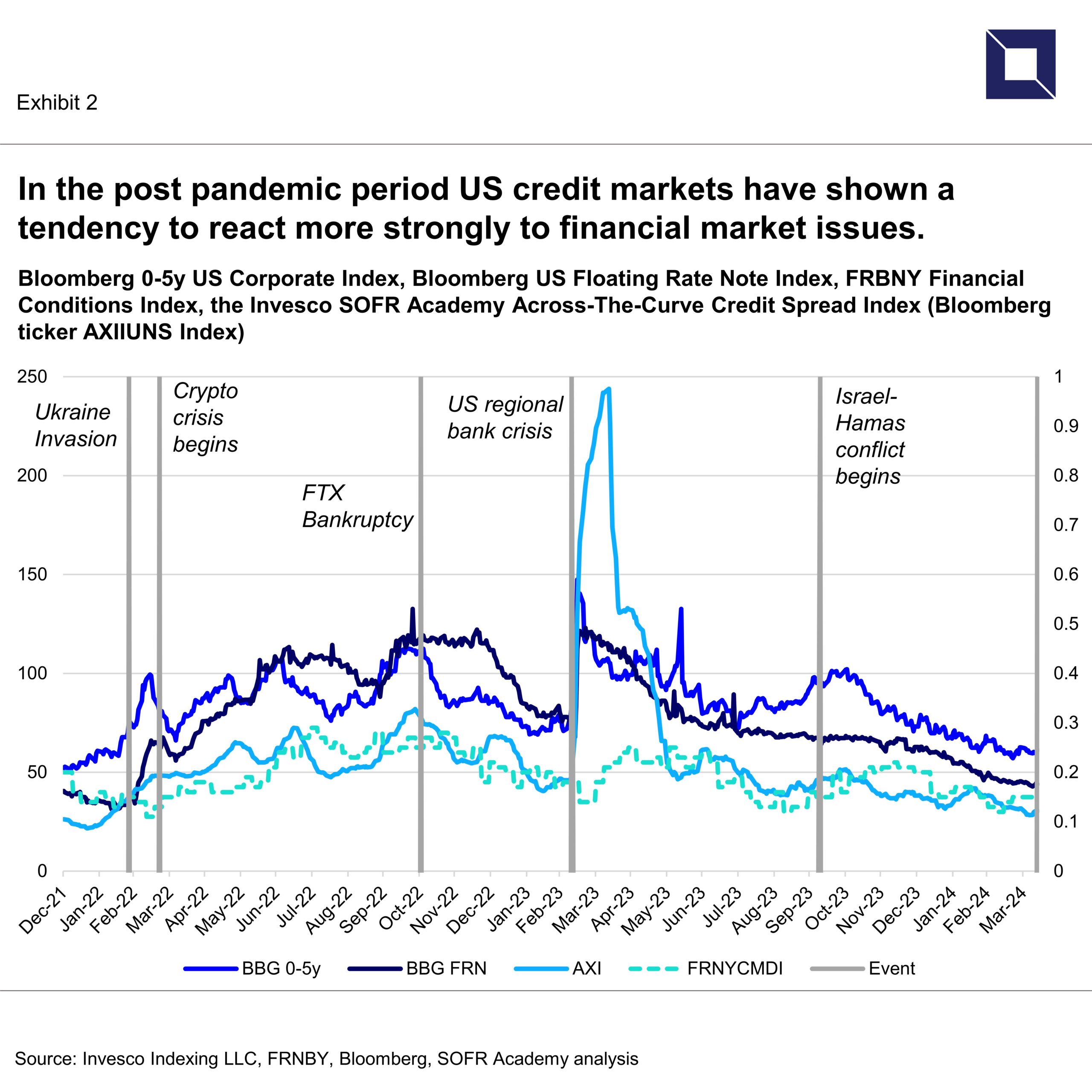

Exhibit 2 provides a similar analysis during the same period with a somewhat different set of data that includes:

- The Bloomberg 0-5y US Corporate Index (Bloomberg ticker I31658US Index), a total return benchmark index,

- The Bloomberg US Floating Rate Note Index (another total return benchmark index, which is mainly composed of floating rate debt of financial institutions; Bloomberg ticker BFRNTRUU Index ).

- The FRBNY financial conditions index (to benchmark broader impact of the events)

- The Invesco SOFR Academy Across-The-Curve Credit Spread Index (AXIIUNS Index). AXI is a broad-based corporate credit index constructed from actual trades on US-dollar denominated banks and financial institution bonds with maturities from overnight to five years.

For reference purposes, major geopolitical and financial market events are noted on the charts.

As the data illustrate, in the post pandemic period US credit markets have shown a tendency to react more strongly and persistently to financial market issues of various forms, while upticks in geopolitical risks have resulted in less impact. One possible explanation for this is the prominence of bank and financial debt in the US bond markets. Moreover, market participants have become accustomed to bank and financial crises of various forms, and many have developed something akin to a “gag reflex” that pushes them to reduce risk as headlines drop.

In contrast, geopolitical risks are more unique. Following initial headlines and perhaps an initial risk-off shock, the substance and timing of follow-on events can be ambiguous. As these follow-on events develop – or don’t develop — the market impact of the initial shock can erode. Another geopolitical factor that would exert greater influence on markets would be the impact of changes on global import/export markets. For instance, a prolonged shut-down to key shipping routes or pipelines would pressure commodity supply channels, and likely influence credit markets to a greater degree.

While we have no way of knowing if this is the case with current events, the metrics of credit risk reflected in AXI, FXI and other USD credit indices seem somewhat insensitive for now.

Alex Roever, CFA, is a Senior Advisor at SOFR Academy ([email protected]).

This note is provided for informational purposes by SOFR Academy, Inc. (SOFR Academy), an economic education and market information provider. This note is not designed to be taken as advice or a recommendation for any investment decision or strategy. Readers should make an independent assessment of relevant economic, legal, regulatory, tax, credit, and accounting considerations and determine, together with their own professionals and advisers, if the use of any index is appropriate to their goals. Neither the Invesco / SOFR Academy USD Across-the-Curve Credit Spread Index (AXI), nor the Invesco / SOFR Academy USD Financial Conditions Credit Spread Index (FXI) are associated with or sponsored by the Federal Reserve Bank of New York or any regulatory authority. Additional information about SOFR Academy, AXI and FXI can be found here.

Copyright 2024 SOFR Academy, Inc. All rights reserved