Across-the-Curve Credit Spread Indices (AXI)®

The USD Across-the-Curve Credit Spread Indices (AXI)® and the USD Financial Conditions Credit Spread Indices (FXI)® were officially launched July 12th, 2022 and are published by recognized benchmark administrator Invesco Indexing LLC which is owned by American investment management firm Invesco Ltd (NYSE: IVZ). To submit questions or request licensing information please email [email protected].

Watch the ISDA Benchmark Strategies Forum held in New York >

SOFR Academy supports the Secured Overnight Financing Rate (SOFR).

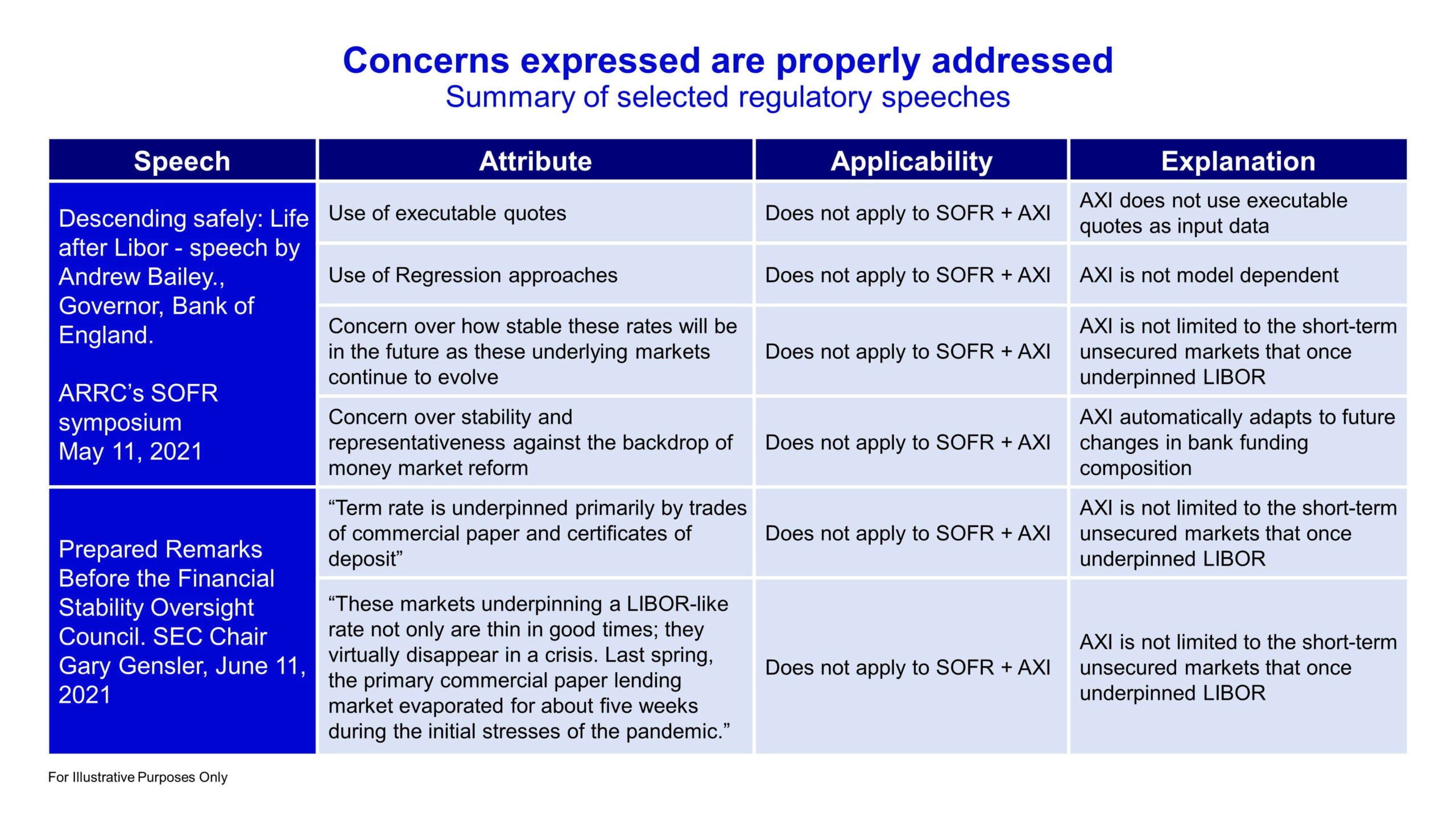

In September 2019, a collection of ten large American regional banks wrote to US bank regulators expressing their support for SOFR and requesting the creation of a SOFR-based lending framework that includes a credit risk premium (Marshall, et al, 2019). A credit sensitive element enables banks to avoid mismatches between their assets and liabilities in times of market stress and promotes their ability to “extend credit during both good times and bad.” The Invesco / SOFR Academy USD Across-the-Curve Credit Spread Index (AXI) and its extension the USD Financial Conditions Credit Spread Index (FXI) were developed and launched in July 2022 to satisfy this request.

Over the past decade, regulations have induced banks to term out their funding to longer maturities significantly reducing volumes of interbank unsecured term borrowing which called into question the ability of LIBOR to continue playing its central role (Committee on the Global Financial System, 2018). Therefore, a robust and representative credit sensitive benchmark supplement must stay away from LIBOR and instead be primarily built upon the longer-term wholesale transactions that occur across the maturity spectrum. This is the fundamental premise behind the construction of AXI and FXI.

AXI is a fully transaction-based measure of the recent cost of wholesale unsecured debt funding for publicly listed US bank holding companies and commercial banks. It is the weighted average of credit spreads for unsecured debt instruments with maturities ranging from overnight to five years, with weights that reflect both transaction and issuance volumes. The primary underlying input data source is obtained from Financial Industry Regulatory Authority’s (FINRA) Trade Reporting and Compliance Engine (TRACE) which is a mandatory post-trade transparency requirement. This long-term bond component is complemented by the short-term component obtained from the Depository Trust & Clearing Corporation (DTCC). No transactions from private markets or unregulated proprietary exchanges / platforms are used. FXI is constructed through the same methodology as AXI, however coverage is widened to include non-bank financial issuers and US corporate debt. AXI and FXI are generally highly correlated.

AXI and FXI are available only as supplements to SOFR, and therefore their usage does not create a path for banks to skip SOFR. Further, under a two-benchmark regime comprised of SOFR and AXI / FXI, market participants would trade both SOFR- and AXI / FXI-based instruments. Hence, AXI / FXI can grow without diverting any liquidity from SOFR (Tuckman, 2023). No combined ‘all-in’ rate involving Term SOFR and AXI or FXI will be produced and provisions within the Invesco AXI Master License Agreement preclude this from occurring.

Invesco Indexing LLC is committed to maximum transparency regarding AXI and FXI and to maintaining the benchmarks to the highest possible standards. Detailed statistical information is published each business day and links to obtain samples of input data are provided as well as detailed methodology documentation.

AXI and FXI are highly robust and unquestionably representative benchmarks that are underpinned by thousands of transactions. Underlying input data is obtained only from the highest quality sources and is not limited to the short-term markets. The benchmarks maintain their robustness and representativeness over time and the underlying bond transactions volumes do not decline in a crisis (e.g. Regional banking crisis of March 2023). Questions and feedback are welcome, and can be directed to [email protected].

For questions and licensing information please contact [email protected]

VIEW THE INVESCO AXI WEBSITE >

- *New | Invesco AXI Brochure [Download]

- New Insight | How large regional banks can succeed in a higher interest rate environment

- Across-the-Curve Credit Spread Indices | Berndt, Duffie & Zhu (2023)

- Bank Funding Risk, Reference Rates, and Credit Supply | Cooperman, Duffie, Luck, Wang, and Yang (2023)

- *New Insight | Three Critical Problems AXI Solves for Banks

- *New | Bloomberg and Refinitiv ticker codes [Download PDF]

- *New | Invesco Indexing and SOFR Academy announce official launch of the Invesco USD Across-the-Curve Credit Spread Indices (AXI)

- *New Insight | Solving the SOFR credit-spread problem: The path forward for leading banks

- SOFR Academy response to FASB on reference rate reform and derivatives and hedging

- AXI – FHFA Supervisory Letter – Alternative Reference Rate Selection Risk Management

- Prepared Remarks at the Loan Syndications and Trading Association (LSTA) LIBOR transition Q&A Call

- AXI Technical White Paper [Download PDF]

- AXI Technical White Paper 跨曲线信用利差指数 (Chinese version) [Download PDF]

- Notification of Technical Enhancement to AXI Scaling Methodology [Download PDF]

- Term SOFR + AXI Concept Credit Agreement – With permission from the LSTA [Download PDF]

- AXI Product Disclaimer [Download PDF]

Educational Resources

- Financial Stability Considerations in connection with USD-AXI and USD-FXI (Download PDF)

- Financial Stability Considerations in connection with USD-AXI and USD-FXI (Download Word document)

- Loan Syndications and Trading Association (LSTA) webinar [requires LSTA membership]

- Asia Pacific Loan Market Association (APLMA) webinar [requires APLMA membership]

- User friendly Infographic: Across-the-Curve Credit Spread Index (AXI)

- AXI – Frequently Asked Questions

- YouTube Video: Across-the-Curve Credit Spread Index (AXI)

- Op-Ed | The Case For An Across-the-Curve Credit Spread: Transitioning From LIBOR Sustainably

- PRMIA Webinar, August 18, 2021 | Credit Sensitivity & the Across-the-Curve Credit Spread (AXI)

- Research | Working Paper |Hoover Institution | Across-The-Curve Credit Spread Indices (AXI)

- Stanford Business School: Across-The-Curve Credit Spread Indices by Antje Berndt, Darrell Duffie, Yichao Zhu

- Federal Reserve Bank of New York: Credit Sensitivity Group Workshops

- Reforming Major Interest Rate Benchmarks – Financial Stability Board (2014)

- Reforming LIBOR and Other Financial-Market Benchmarks (2014) – Darrell Duffie (Stanford) & Jeremy Stein (Harvard)

Industry Engagement

- SOFR Academy, Inc. comment letter | Regulation Implementing the Adjustable Interest Rate (LIBOR) Act

- SOFR Academy CEO’s letter to New York Fed regarding forthcoming launch of Across-the-curve credit spread indices (AXI)

- SOFR Academy letter to the Financial Accounting Standards Board |Reference Rate Reform (Topic 848) and Derivatives and Hedging (Topic 815)

- Press Release: SOFR Academy Engages Invesco Indexing as Index Provider of Across-the-curve Credit Spread Index (AXI)

- Press Release: SOFR Academy Completes Series of U.S. Official Sector Meetings Regarding the Across-the-Curve Credit Spread Index (AXI)

- Press Release: SOFR Academy announces its intention to publish the Across-the-Curve Credit Spread Index, also known as ‘AXI’

- Letter to the Alternative Reference Rates Committee (ARRC) regarding the Across-the-Curve Credit Spread Index (AXI)

- Letter to leading Associations representing American Non-Financial Corporations

- Letter to U.S. Regional Bank Signatories

Media and Trade Associations

- Risk.net article | NY Fed paper warns of systemic risks from SOFR credit lines

- Risk.net article | Iosco steps up scrutiny of credit-sensitive rates

- Risk.net article | The Libor replacement stakes: runner and riders

- Risk.net article | Pick a rate: pitfalls and prizes in the post-Libor world

- Risk.net article | Clock auctions: a stitch in time for Libor?

- Bloomberg | ‘Let 1,000 Libor Replacements Bloom’

- Risk.net article | “Stanford’s Duffie Shakes Up SOFR Credit Race With AXI Index”

- LSTA | LIBOR transition: CFA covers “sensitive” subject

- P.R.I.M.E Finance Webinar Replay | Getting Beyond LIBOR – 28 June 2021|

- Lexology | Solving the SOFR credit-spread problem: The path forward for leading banks

Other Commentary

- Macquarie Bank | IBOR Transition – Frequently Asked Questions

- Mayer Brown | Eeny, Meeny, Miny, Muse; Which LIBOR Alternative Shall I Choose?

- Western Asset Management Company | LIBOR Transition Update – When Does the New Term Begin?

- SECOR Asset Management | Considerations for a Transition to SOFR and other Alternative Rates

- GARP | On the Road to the Libor Transition: New Solutions Sought and Proposed

- ING | IBOR transition Frequently asked questions

- Seeking Alpha | ‘CME Group’s Looming LIBOR Crisis’

- Oliver Wyman webinar replay – LIBOR Transition: Looking Forward

Sign up for a consultation on AXI >

SOFR Academy, Inc. reserves all rights in the methodologies and outputs disclosed in this document, the white paper, the updates to the white paper and on SOFR Academy, Inc.’s website, and in the copyright in this document, the white paper, the updates and on SOFR Academy, Inc.’s website. None of these rights may be used without a written license from SOFR Academy, Inc. SOFR Academy, Inc. holds the exclusive word-wide rights to commercialize the intellectual property (IP) associated with Across-the-Curve Credit Spread Index (AXI) nor the Financial Condition Credit Spread Index (FXI), this includes but is not limited to the literary work, the algorithm / code, all trade secrets, know-how, trademarks, designs, copyright, whether or not registered or registrable or having to undergo any other process for grant, registration or the like.

In particular, AXI & FXI are not intended for use as, and SOFR Academy, Inc. expressly prohibits their use as, an index by reference to which the amount payable under a financial instrument or a financial contract, or the value of a financial instrument, is determined, or as an index that is used to measure the performance of an investment fund with the purpose of tracking the return of such index or of defining the asset allocation of a portfolio or of computing the performance fees. Such outputs may not be used as a benchmark within the meaning of the EU Benchmarks Regulation or otherwise.

The methodologies disclosed in this document, the white paper and the updates and on SOFR Academy, Inc.’s website are subject to changes in response to feedback from market participants and other stakeholders and SOFR Academy, Inc.’s further development work. These changes might alter the outputs shown in this document, the white paper, the updates and on SOFR Academy, Inc.’s website. There is no guarantee that SOFR Academy, Inc. will continue to test the Index, be able to source data to derive the Index or publish the Index in the future. Users of LIBOR should not rely on the potential publication of AXI & FXI when developing and executing transition or fallback plans.

None of SOFR Academy, Inc., any providers of data for the Index or any of its or their affiliates accepts any responsibility or will be liable in contract or tort (including negligence), for breach of statutory duty or nuisance or under antitrust laws, for misrepresentation or otherwise, for the information contained in this document, the white paper, the updates or on SOFR Academy, Inc.’s website, or any use that you may make of it. All implied terms, conditions and warranties and liabilities in relation to the information are hereby excluded to the fullest extent permitted by law. None of SOFR Academy, Inc., any data providers, or any of its or their affiliates excludes or limits liability for fraud or fraudulent misrepresentation, or death or personal injury caused by negligence.

Financial Industry Regulatory Authority, FINRA, Trade Reporting and Compliance Engine, and TRACE are trademarks of Financial Industry Regulatory Authority, Inc. (FINRA), in the US and/or other countries. All rights reserved. See http://www.finra.org/industry/trace for further details regarding TRACE. The AXI & FXI is not associated with, or endorsed or sponsored by, FINRA. SOFR is published by the Federal Reserve Bank of New York (The New York Fed) and is used subject to The New York Fed Terms of Use for Select Rate Data. The New York Fed has no liability for your use of the data. Neither the AXI & FXI are associated with, or endorsed or sponsored by, The New York Fed.