Market Insight – April 2024

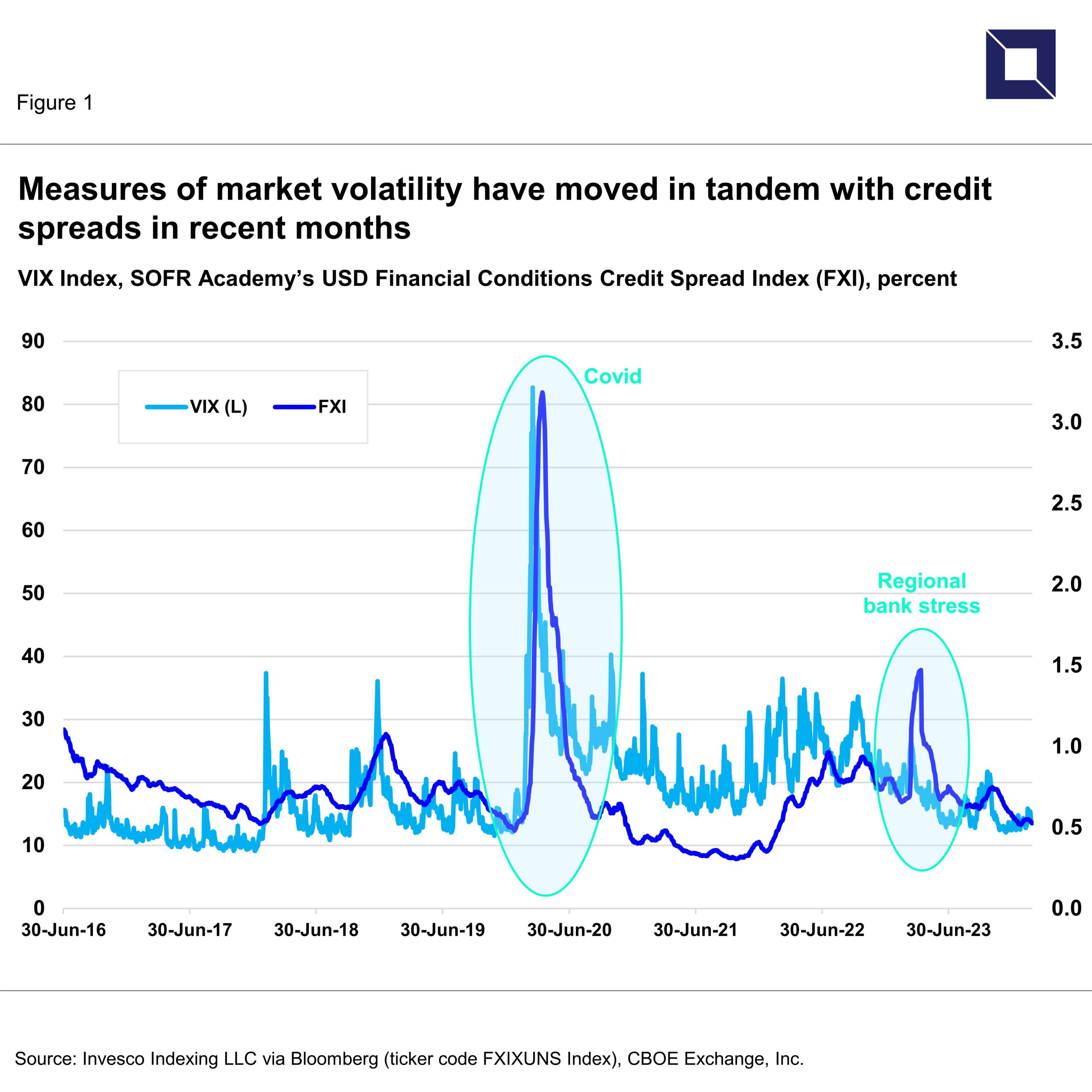

Measures of credit spreads moved tighter and market volatility edged lower around the end of 2023. This trend continued during the first quarter of this year. These more tranquil market conditions have provided a favorable backdrop for corporate bond issuance and deal activity. But what forces are driving this calm and how long can it last?

A recent Wall Street Journal article suggested that investors moving into low volatility strategies may be contributing to driving tranquility in markets and raising fears of a potential build-up of risk (Grant, 2024). These types of funds tend to perform best in a sideways market when stocks don’t move up or down too quickly.

Another possible force driving credit spreads tighter is the intensification of competition from private market lenders in the United States. BlackRock’s Head of Macro Credit Research, Amanda Lynam, wrote in a recent client note, “competition between syndicated and private markets, coupled with ample private debt dry powder, has encouraged tighter pricing, especially for larger borrowers who have access to both markets” (Lynam, 2024).

Robert Armstrong of the Financial Times took this question a step further asking his readers “is there any limit on how tight spreads can go?” (Armstrong, 2024). Explanations include the continued soft landing in the United States and the relatively low corporate default rates that continue to being observed.

“Another possible force driving credit spreads tighter is the intensification of competition from private market lenders in the United States.”– Amanda Lynam, BlackRock

SOFR Academy’s USD Financial Conditions Credit Spread Index (FXI) has moved in concert with this trend, making new lows in recent months (see Figure 1). FXI has been underpinned by around $2 trillion in notional transaction volume recently, with maturities out to 5-years and more than 700,000 individual transactions each day (Invesco, 2024).

This makes FXI a reliable, contemporaneous and broad measure of financial conditions across the broader United States economy. FXI can therefore serve as a representative benchmark for private market lending and related derivatives risk management applications when combined with the Secured Overnight Financing Rate (SOFR) as a market-based measure of average funding costs for non-bank issuers (Berndt, Duffie & Zhu, 2023).

In a speech last week at the the Economic Club of New York, Federal Reserve Governor Christopher J. Waller commented that “the remarkable U.S. economy keeps on chugging along” (Waller, 2024). It is remarkable, and time will tell how long we can keep chugging.

Marcus Burnett is CEO of SOFR Academy ([email protected]).

This note is provided for informational purposes by SOFR Academy, Inc. (SOFR Academy), an economic education and market information provider. This note is not designed to be taken as advice or a recommendation for any investment decision or strategy. Readers should make an independent assessment of relevant economic, legal, regulatory, tax, credit, and accounting considerations and determine, together with their own professionals and advisers, if the use of any index is appropriate to their goals. Neither the Invesco / SOFR Academy USD Across-the-Curve Credit Spread Index (AXI), nor the Invesco / SOFR Academy USD Financial Conditions Credit Spread Index (FXI) are associated with or sponsored by the Federal Reserve Bank of New York or any regulatory authority. Additional information about SOFR Academy, AXI and FXI can be found here.

Copyright 2024 SOFR Academy, Inc. All rights reserved