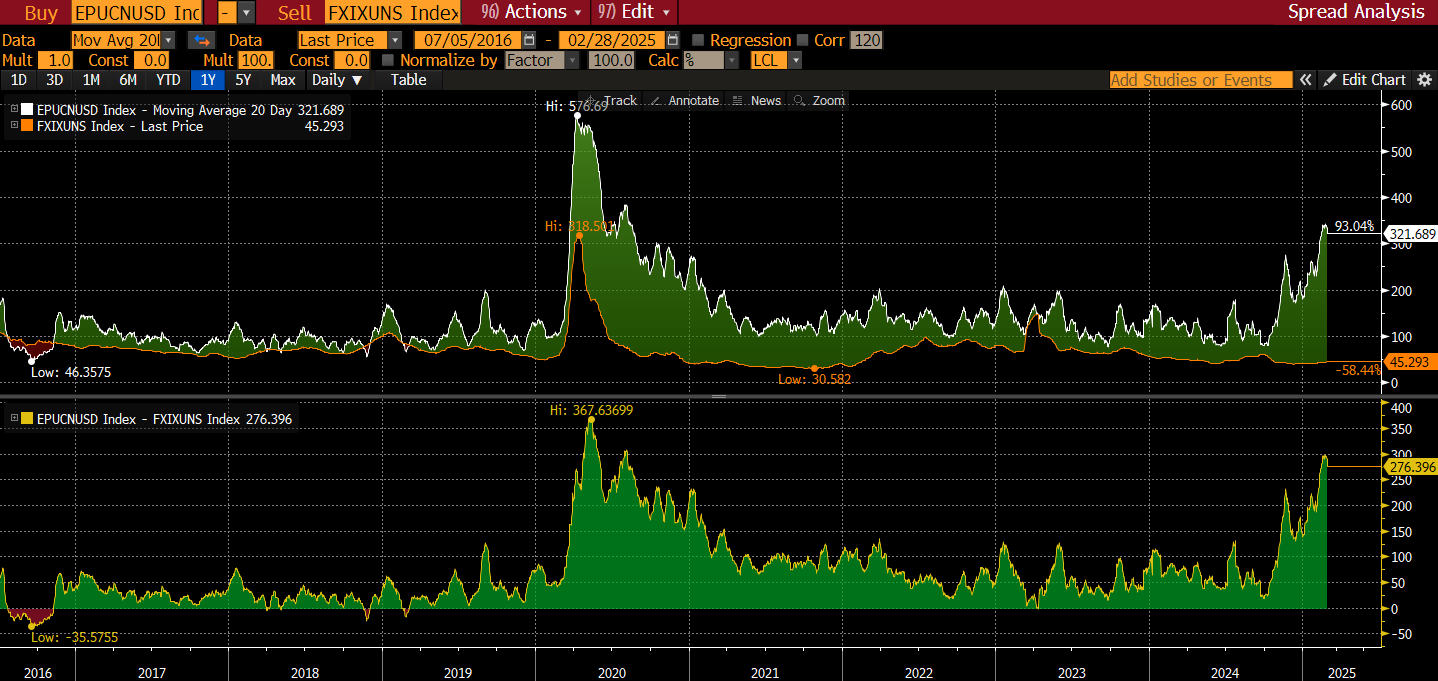

Market Insight – March 2025. Recent market trends highlight an unusual divergence between economic policy uncertainty and credit spreads.

A widely followed Economic Policy Uncertainty (EPU) Index (Baker, Bloom and Davis) has surged sharply in recent weeks, reflecting mounting concerns over macroeconomic stability, fiscal policy shifts, and geopolitical risks. Yet, the Financial Conditions Credit Spread Index (FXI)—an IOSCO-aligned, fully transactions-based broad measure of credit spreads—has remained relatively stable, showing only a modest upward trend. Given that FXI captures real-time financial conditions across multiple maturities and investment grade credit sectors, its resilience stands in stark contrast to the historical pattern where heightened uncertainty typically leads to wider credit spreads.

Apollo’s Chief Economist, Torsten Sløk, has pointed to this anomaly as a growing concern. In normal market cycles, rising policy uncertainty prompts investors to demand higher compensation for risk, causing credit spreads to widen. Yet, this expected repricing has not materialized, raising key questions: Are markets overly complacent? Is excess liquidity suppressing risk signals? Or is the credit market underestimating future economic headwinds?

Chart source: Bloomberg

Several factors may explain why credit spreads have remained contained despite the surge in policy uncertainty. Ample liquidity in the financial system, supported by central bank policies and strong corporate balance sheets, has likely dampened risk premiums even as uncertainty increases. Additionally, credit markets often react with a lag compared to equities, meaning that spread widening could still materialize if uncertainty persists. Another possibility is that investors expect policymakers to intervene and prevent severe market dislocations, reinforcing confidence and delaying any meaningful repricing of credit risk.

Also, keep in mind that the EPU is a news-based index, and since the inauguration the volume of economic policy related news stories has surged at an unprecedented pace. However, the details and implications of potential new policies are only slowly beginning to emerge, and so far credit markets seem willing to wait for further information.

“Credit spreads have not responded the way they normally do to rising policy uncertainty ”– Torsten Sløk, Apollo Chief Economist

Is Stability in Credit Spreads Sustainable?

The critical question for investors is whether the policies that follow from these headlines will pose risks to financial stability and credit spreads. The pro-business and deregulatory leanings of the Administration suggest support for healthy credit markets. However, the prospect of fiscal and trade policies that might spur inflation, or significant changes to the administration of monetary policy could translate into greater market sensitivity.

Chart source: Bloomberg

Vigilance in the Face of Uncertainty

For now, given the disconnect between surging policy uncertainty and resilient credit spreads, investors should remain vigilant. While spreads have yet to react meaningfully, history suggests that sustained uncertainty rarely leaves credit markets unscathed in the long run. Monitoring shifts in liquidity conditions, policy developments, and credit risk sentiment will be essential in navigating potential turning points. As we have previously discussed, FXI (Bloomberg: FXIXUNS Index) is a useful tool for monitoring demonstrated market sentiment.

Alex Roever, CFA, is the former Head of U.S. Interest Rate Strategy at JP Morgan and a Senior Advisor at SOFR Academy ([email protected]).

This note is provided for informational purposes by SOFR Academy, Inc. (Sofr.org), an economic education and market information provider. This note is not designed to be taken as advice or a recommendation for any investment decision or strategy. Readers should make an independent assessment of relevant economic, legal, regulatory, tax, credit, and accounting considerations and determine, together with their own professionals and advisers, if the use of any index is appropriate to their goals. Neither the USD Across-the-Curve Credit Spread Index (AXI), nor the USD Financial Conditions Credit Spread Index (FXI) are associated with or sponsored by the Federal Reserve Bank of New York or any regulatory authority. Additional information about SOFR Academy, AXI and FXI can be found here.

Copyright 2025 SOFR Academy, Inc. All rights reserved