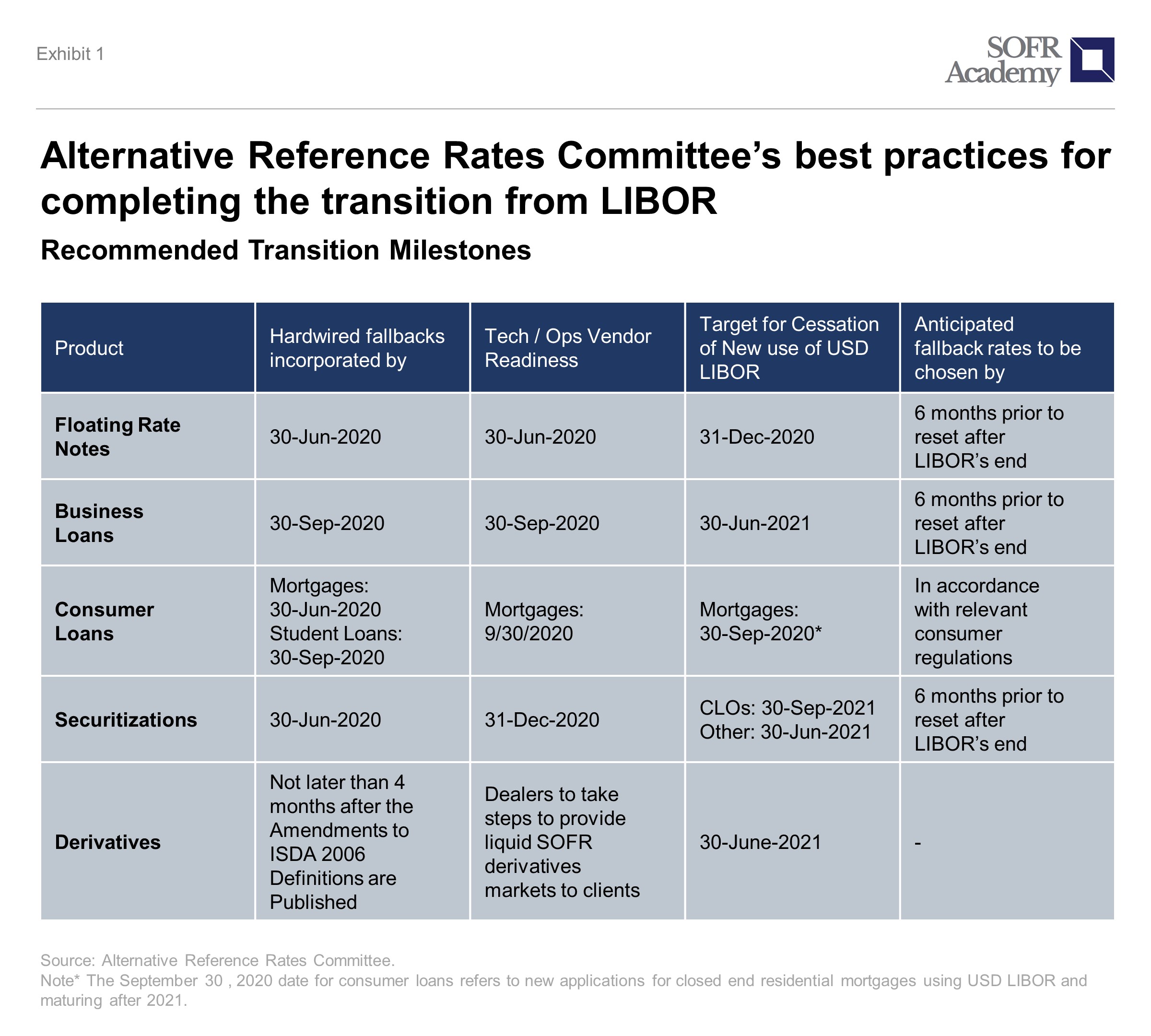

The ARRC has published best practices for completing the transition from LIBOR to SOFR including guidance on cutoff dates for new LIBOR activity. Here is how financial institutions can stay on track.

Yesterday the Alternative Reference Rates Committee (ARRC) published a series of best practices for completing the transition from LIBOR that include specific date-based guidance for the rest of 2020 and 2021. In doing so, the ARRC has provided market participants with important clarity as the industry moves into the “game time” portion in the monumental transition away from LIBOR.

Despite the disruption caused by COVID-19, the United Kingdom’s Financial Conduct Authority (FCA) has reaffirmed that the ultimate end date for LIBOR remains unchanged. At the conclusion of 2021, the agreement between the FCA and the LIBOR panel banks will expire, and those banks will no longer be compelled to submit LIBOR rates.

The impact of COVID-19 has raised the level of uncertainty around Libor transition programs’ interim milestones, and this publication by the ARRC helps mitigate it. The best practices provide near term practical steps that institutions should take to meet these recommended transition milestones.

A successful and orderly transition away from LIBOR must be broad-based. With only nineteen months left until LIBOR likely becomes unstable or unusable, institutions are still showing varying degrees of preparedness. These new best practices offer a roadmap to both foster a renewed sense of urgency in their LIBOR transition programs and demonstrate to regulators the concrete actions being taken to achieve the interim milestones.

Institutions must pledge to adhere to the new best practice milestones, for those who don’t risk falling behind or losing market share to competitors. One of the lessons from the 2008 global financial crisis, which we believe applies accordingly to the Libor transition during COVID-19, is that institutions which press forward with business initiatives through a crisis are likely to be better positioned upon the ensuing economic recovery. We propose five key actions below that institutions should undertake to actively set up LIBOR transition programs for success in achieving the ARRC’s best practice milestones.

- Communicate the ARRC’s best practices and provide education. Institutions should leverage the communication and education channels set up through their LIBOR transition programs to socialize information on ARRC’s best practices, including critical date-based cutoffs for LIBOR-linked products. The new best practices should also be incorporated into external communications strategies to clients and customized where applicable. A confirmed intention by a financial institution to discontinue a LIBOR based product in which a client regularly transacts should be communicated in a timely fashion, and in language appropriate for the client.

- Integrate the ARRC’s best practice milestones into your LIBOR transition program. Update program plans and internal transformation roadmap for new ARRC best practice milestones including LIBOR-linked product cutoff dates. Set up new processes and requirements to regularly report progress against the ARRC’s best practice milestones over the next eighteen months. Consider assigning ownership of benchmarking progress to the LIBOR Transition Office (LTO) and producing reporting for Senior Management consumption.

- Recalibrate internal milestones and assess potential dependencies to enable adherence with new best practice milestones. Consider where there may be additional stress on resources as a result of the new best practice milestones. Identify where any bottlenecks may form as well as incremental internal dependencies and identify mitigating strategies. Examine how the USD interim milestones will impact transitions for other currencies and get ‘in-sync’ from a cross jurisdictional perspective.

- Identify key areas that may require operational uplift in order to meet new milestones. Resources may call for a shift of focus or re-prioritization to meet the new milestones. A temporary reallocation of headcount resources might be required. For external technology vendors, monitor their progress against the ARRC’s vendor readiness dates and anticipate any slippage and flow on impact for institutions’ best practice guideline dates.

- Remain actively engaged with regulators and industry working groups. Advocate for your institution’s position in industry forums and socialize any significant concerns in achieving the new best practice milestones. Invest the time and resources required to respond to industry consultations and regulatory requests for information. Anticipate key industry developments including the clearinghouse switch from EFFR to SOFR discounting, ISDA’s upcoming protocol, and the US Treasury’s Request for Information (RFI) exploring the possibility of issuing a SOFR linked Floating Rate Note

Marcus A. Burnett is a former interest rate trader and Director of SOFR Academy. The author would like to thank Chris Babu, an Advisor at SOFR Academy, for his contribution to this article.