An intensification of regulatory focus of large regional banks’ management and oversight of interest rate risk, credit spread risk and liquidity will require a bold and intentional response from bank executives. We see five priorities for leading banks to get ahead of upcoming changes.

In the wake of three bank failures (Silicon Valley Bank, Signature and Silvergate) and concerns about a fourth (First Republic), regulatory supervision is likely to evolve. President Biden has recently urged regulators, in consultation with the Treasury Department, to strengthen safeguards and supervisions for large regional banks to reduce the risk of future banking crises (The White House: Fact Sheet, March 2023). An intensification of regulatory scrutiny of large regional banks’ management and oversight of interest rate risk, credit spread risk and liquidity will require a bold and intentional response. Having held discussions with a number of large regional banks, we see five overarching themes for leading banks to keep in mind ahead of upcoming changes.

1. Set the tone at the top.

The mindset and practice’s of the senior leadership at a bank set an example for others. Senior management must set the tone at the top of the bank with respect to risk culture by role modeling. In doing so, bank executives set a standard by which others can follow. The organization should compensate and promote people to encourage them to act in the organizations best long-term interests. Bank executives must define risk culture and risk appetite, then insist on rigorously measuring and managing risks metrics.

“if, for example, bank executives’ compensation shifted away from cash and equity toward subordinated debt that they had to hold for several years, they would be less inclined to take the kinds of risks that could lead to failure ”– Former Federal Reserve Bank of New York President William C. Dudley

Soon, senior managers may have stronger incentives to do so. Former Federal Reserve Bank of New York President William C. Dudley recently suggested that “if, for example, bank executives’ compensation shifted away from cash and equity toward subordinated debt that they had to hold for several years, they would be less inclined to take the kinds of risks that could lead to failure and the write-off of that subordinated debt” (Dudley, 2023). Management bears the ultimate responsibility for the oversight of the risk management framework and the institution’s risk appetite framework to adequately cover risks, including credit and interest risks.

2. Foster agility in stress testing processes and procedures.

Heightened uncertainty in the present economic climate require banks to to be able to response to unforeseen events more quickly and models must be able to run scenarios that incorporate a wider range of factors. President Biden’s March 30th Fact Sheet called for enhancements to the requirements of stress testing for both liquidity and capital for banks like SVB. Substantial uncertainty exists regarding the specific changes that will be made to stress testing and the corresponding scenarios. It’s likely that stress tests will be updated to reflect risks associated with a higher interest rate environment including in the context of asset-liability management.

In connection with the industry transition to the Secured overnight Financing Rate (SOFR), Stanford University’s Darrell Duffie called for updates to stress tests (Bartholomew, 2023) based on work outlined in a staff paper from the Federal Reserve Bank of New York (Cooperman, Duffie, Luck, Wang and Yang, 2023). It seems likely that bank stress tests will be updated, potentially in multiple ways, and that the number of banks required to perform them may be expanded, however the exact nature and timing of those updates remains to be seen. Banks that fail to adapt to new scenarios and stress test updates in a timely fashion may be forced to rely on undesirable manual overlays.

Although details are not yet available, and may not be for some time to come, it seems clear that regulation is likely to increase, and so is supervision. Given this context, it would be prudent for banks executives to support the adoption of more agile process to stress testing processes. Banks that become more nimble in responding to changes in stress testing processes can reduce implementation costs and increase the speed of their response.

3. Integrate discussion of contemporaneous credit spreads.

SOFR, in it’s various forms, will constitute the bedrock benchmark rate for the United States with USD LIBOR set to be discontinued at end of June 2023. SOFR is a near risk-free rate which means that banks need to think differently about credit spread risk and measuring credit conditions in a post LIBOR world.

In times of market stress, like we have experienced recently, risk free rates like SOFR tend to move lower (as the market moderates expectations for future increases in the Federal Funds Rate) while banks actual costs of funds tends to move higher as investors demand higher yields on bank debt. It was this mismatch between assets (loans) and liabilities (deposits) that was flagged as a key concern by a collection of regional banks to US market regulators together along with a request for the development of a representative credit sensitive supplement to SOFR that would help offset this mismatch (Letter from US Regional Banks, 2019).

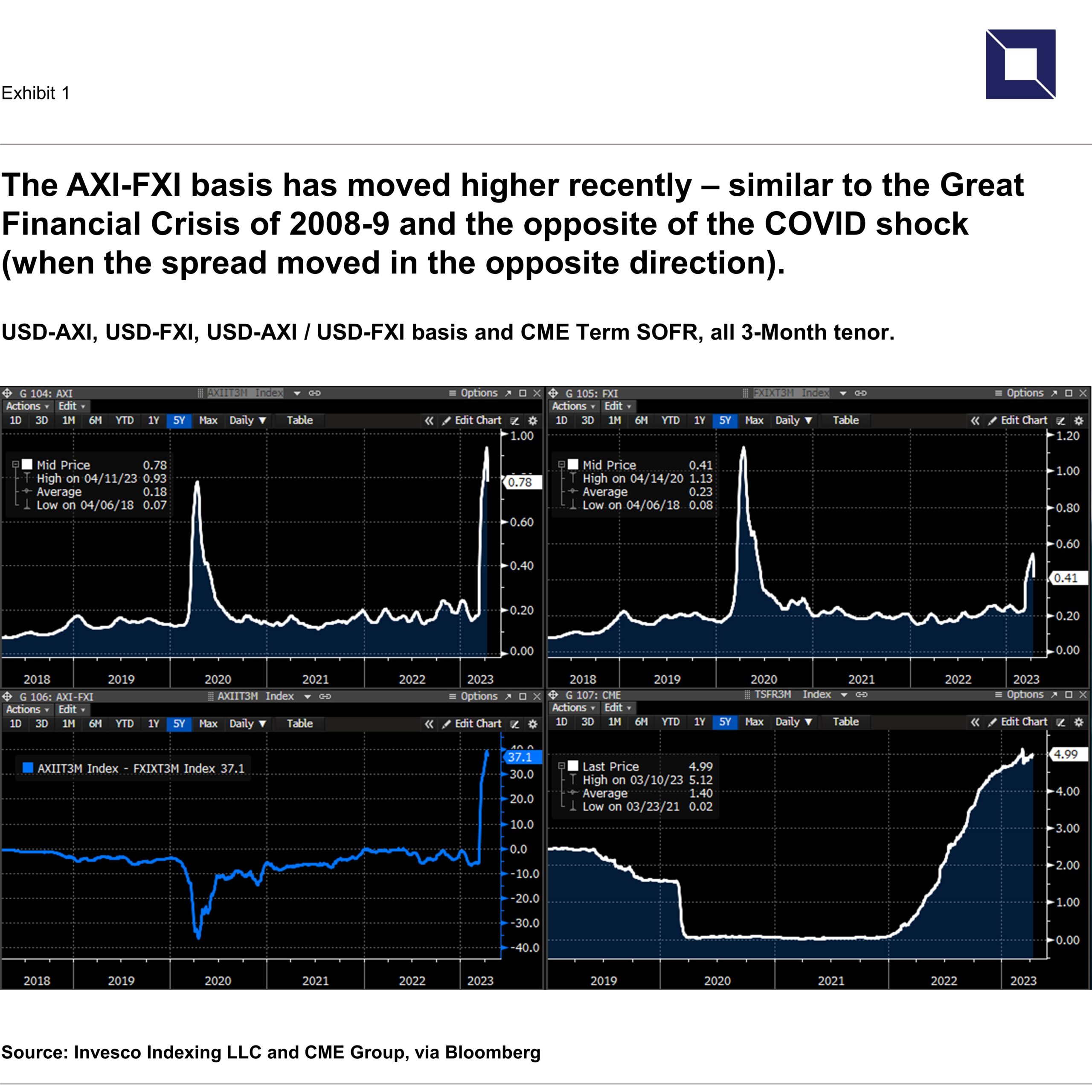

Large regional banks should monitor representative credit sensitive indicators such as Invesco’s USD Across-the-Curve Credit Spread Index (USD-AXI) and its extension the USD Financial Conditions Credit Spread Index (USD-FXI), which were launched in July 2022 as a supplements to SOFR. The indices have responded as designed to the SVB induced market stress by moving higher and more recently coming back down (Exhibit 1). The extent to which the most recent bank asset-liability mismatch created frictions in lending markets and on the credit channel is not yet known, however it has been shown (Ghamami, 2023) that a credit spread supplement used in conjunction with SOFR can help mitigate this. It is also becoming increasingly clear that banks should review deposit pricing strategy, and this cannot occur without consideration of bank assets (Burnett, 2023).

Input data used to calculate the benchmarks depend on a broad range of maturities from short term out to multiple years ensuring benchmark representativeness and robustness are sustained over time. According to data obtained from Invesco Indexing, the administrator and publisher of the benchmarks, a substantial increase in the longer term transaction volume that are used to calculate USD-AXI was observed around March 13th. Studies can determine whether this was due to bank treasurers preemptively securing additional funding or was in reaction to corporate borrowers drawing down credit line facilities.

Like to view the latest Invesco AXI rates?

Visit Invesco’s USD-AXI website>

It is interesting to note that Invesco’s USD Financial Conditions Credit Spread Index (USD-FXI), pronounced “fixie”, which is USD-AXI’s sister index where input data is expanded beyond banks to include funding transactions from non-banks and American corporates, did not move as high as USD-AXI. This indicates that funding stress in this recent event was largely contained to the banking sector and did not spill over into the broader economy, in contrast to the COVID shock.

4. Invest in reporting tools to more accurately quantify risks.

Once risk and integrity culture is defined, measurement can begin. The Federal Reserve has increased interest rates at a pace not seen in decades in response to a level of inflation that is substantially higher than desired, which has impacted measures of credit risk in the market. Systems, models and reporting tools should be reviewed through the lens of potential enhancements to adapt to the high interest rate environment and evolving credit conditions.

Banks should have in place robust internal measurement systems that capture all components and sources of credit spread risk and interest rate risk which are relevant for the institution’s business model. Internal risk-reporting systems should provide timely, accurate and comprehensive information about their exposures to interest rate and credit risks. The comprehensiveness or the risk-reporting systems should be commensurate with the size, complexity and business mix of the bank (Exhibit 2).

The reporting tools should provide aggregate information as well as sufficient supporting detail to enable the the Board and bank executives to assess the sensitivity of the bank to changes in market conditions and other important risk factors. The content of the reports should reflect changes in the risk profile of the institution and in the economic environment and compare current exposure with policy limits. The limitations of each quantitative tool and model used should be fully understood by the bank, and these limitations should be taken into account in the credit and interest rate risk management process. In assessing risks, institutions should be aware of the risks that may arise as a consequence of accounting treatment of transactions in the non-trading book.

5. Focus on robust enterprise-wide governance.

Banks should review their governance frameworks to allow for more agile decision making while reassessing their effectiveness for risk management (including liquidity and capital) and regulatory compliance. Bank boards and senior executives should make informed and sustainable choices between profit generation balanced against increased exposure to changes in interest rates. As a first step, many banks review committee structures, and terms of reference, benchmarked against peers. A common action is to review organizational capabilities (size, skills, mandates) and responsibilities.

If bank boards and senior executives focus close attention to the management of these five areas, larger regional banks can more accurately assess and manage the impact of rising rates and changing credit conditions across the enterprise. In doing so, they will be better positioned to satisfy upcoming regulatory expectations, and can position their organization to succeed by fostering competitive advantage.

About the Author

Mr. Burnett is chief executive of SOFR Academy, Inc. and is based in New York City.

Disclaimer

The views expressed in this article represent the personal views of the author and do not necessary represent the views of SOFR Academy, Invesco Indexing LLC, Invesco Ltd., or of USD-AXI or USD-FXI license holders. SOFR Academy supports SOFR, and near risk-free rates. We also support robustly defined and representative across-the-curve credit spread supplements such as AXI and FXI over time, which can be used in conjunction with risk-free rates. SOFR is published by the Federal Reserve Bank of New York (The New York Fed) and is used subject to The New York Fed Terms of Use. The New York Fed at has no liability for your use of the data. AXI is not associated with, or endorsed or sponsored by, The New York Fed, or the Federal Reserve System. Darrell Duffie, who is the Adams Distinguished Professor of Management and Professor of Finance at the Graduate School of Business and a co-author of the proposal for AXI, has no related compensation and is not affiliated with SOFR Academy. This post does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions. Invesco Indexing LLC is an indirect, wholly owned subsidiary of Invesco Ltd. Invesco Indexing LLC is legally, technologically and physically separate from other business units of Invesco, including the various global investment centers. Any prospective user of USD-AXI or USD-FXI that would intend to also use CME Term SOFR in developing an interest rate for Cash Market Financial Products of OTC Derivative Products would require a license with CME Group for use of CME Term SOFR. SOFR Academy’s work is separate from but supportive of the Alternative Reference Rates Committee (ARRC). USD-AXI or USD-FXI are currently not benchmarks available for use in the United Kingdom or the European Union.