Irrespective of recently announced delays, it still seems inevitable that SOFR is becoming the main Risk–Free Rate benchmark in US dollars. Historically, interest rate term structure modelling has been based on rates of substantially longer time to maturity than overnight, but with SOFR the overnight rate now is the primary market observable.

In this article for SOFR Academy, Professor Erik Schlögl – Director of the Quantitative Finance Research Centre at the University of Technology Sydney – argues that overnight rates display empirical idiosyncrasies which traditionally have been ignored in interest rate term structure modelling, but which should be properly reflected in models of a SOFR–based world. Foremost of these is the fact that a substantial driver of SOFR dynamics is the Federal Reserve policy target for the effective Fed funds rate (EFFR), which evolves in a step-wise constant fashion, changing generally only on Federal Open Market Committee (FOMC) meeting dates. This article is based on a recent research paper by Karol Gellert and Erik Schlögl.

Many interest rate term structure models in widespread use such as the LIBOR Market Model and its various extensions are based on rates of substantially longer time to maturity than overnight. Even models based on the continuously compounded short rate (i.e., with instantaneous maturity) are typically calibrated to term rates of longer maturities, with any regard to a market overnight rate at best an afterthought. However, with SOFR this situation is reversed: The overnight rate now is the primary market observable, and term rates (i.e., interest rates for longer maturities) will be less readily available and therefore must be inferred (for example from derivatives prices). Thus the empirical idiosyncrasies of the overnight rate should not be ignored when constructing interest rate term structure models in a SOFR–based world, and more than for longer term rates, these idiosyncrasies are driven by monetary policy.

Empirical features of overnight rates

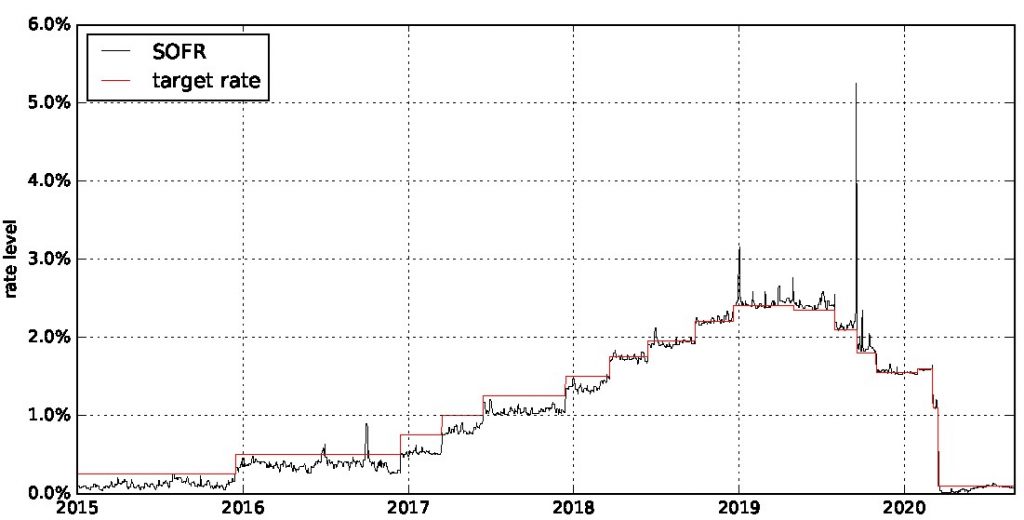

Figure 1: SOFR vs. FOMC target rate history

Consider Figure 1, which plots SOFR and the FOMC target rate from 2015 to 2020. Already by simple inspection one sees that models, in which the overnight rate evolves solely as a diffusion, cannot be justified by empirical data. Instead, a substantial driver of this rate is the piecewise flat behaviour of the policy target rate. This effect is even more evident in EFFR, as Figure 2 shows.

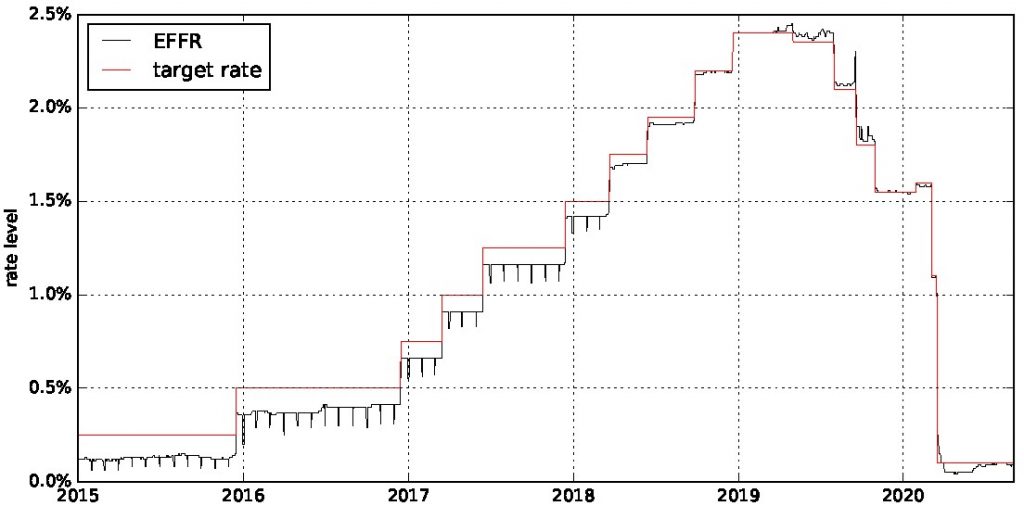

Figure 2: EFFR vs. FOMC target rate history

Thus a major component (let’s call this the policy rate component) of the overnight rate dynamics is given by jumps at known times (the FOMC meeting dates) – to a first approximation at least, EFFR is more or less constant between these times (with the exception of brief upward or downward spikes, to which we’ll get below). On the other hand, forward rates for a selection of maturities can be implied from futures, be they on Fed funds or SOFR

Figure 3: Target rate vs. forward rates implied by three different 30–day Fed Funds futures

Figure 3 plots the evolution of the forward rates implied by three different 30-day Fed funds futures against the target rate. Unsurprisingly, the futures-implied rates end close to the target rate at the maturity of the futures. What is striking, however, is that these forward rates evolve in a manner more resembling a diffusion process over much of the life of the futures. Naively, one might see this as an inconsistency between the forward rate dynamics and the evolution of the overnight (spot) rate. This inconsistency is resolved by noting that forward rates reflect market expectations of future spot rates – these expectations may still change diffusively even if the spot rates themselves follow piecewise constant paths.

Animation: Fed funds futures implied term structure vs. EFFR over time

Consider the above animation: The red (fixed) line shows EFFR over time, while the blue line is the term structure fitted to Fed funds futures observed at each point in time and evolving over time as the animation runs. This illustrates how the increases in the overnight rate until early 2019 and subsequently largely constant overnight rates were well anticipated by the term structure, with some updating of expectations occurring over time. The market also anticipated the return to lower rates, with the futures-implied term structure starting to slope downwards from about May 2019, while the first downward jump of the policy target rate did not occur until the beginning of August.

Modelling overnight rates

The model which we have constructed in our paper has the desired effect for the policy rate component of EFFR and SOFR: The spot value of this component is constant between FOMC meeting dates and jumps on those dates only, while forward rates with maturities beyond the next FOMC meeting date evolve diffusively. This is achieved by diffusions driving the policy rate component which evolve unobserved in the background and only “kick in” at meeting dates, resulting in a jump in the policy rate component. By an appropriate choice of spot and forward rate volatility functions, the model is set up in a way which satisfies the no-arbitrage conditions of the well known Heath/Jarrow/Morton (HJM) framework. For the steps in the target rate modelled in this fashion, a possible economic interpretation is that there is a fundamental “shadow” rate of interest evolving diffusively: Only the central bank observes this shadow rate (perhaps imperfectly), and at known dates updates the central bank target rate to match this shadow rate.

Of course, it is clear from Figure 1 that the policy rate component is not the only thing driving SOFR dynamics. Another prominent empirical feature of SOFR, and to a lesser extent EFFR, is the occurrence of large spikes. The spikes tend to occur at predictable times, often on the last day of the month and particularly on end of quarter and end of year dates. There are some exceptions, such as the extreme spike in September 2019: An explanation provided by the Federal Reserve for the September 2019 spike is that it occurred on a day on which large corporate tax receipts and Treasury bond expiries caused a sharp imbalance in demand and supply in the repo market. However, both the reasons given occur on dates easily obtainable in advance, therefore arguably this spike also could be classified as occurring on a predictable date. Using a similar approach to modelling the policy rate component, our model also allows for spikes occurring on known dates. Finally, we also add an observable diffusive component to reflect any remaining “noise” in the overnight rates.

Figure 4: Contributions to the variation of EFFR in vertical order (i) target rates (ii) end–of–month spikes (iii) residual noise

Figures 4 and 5 show the contribution of the three components to the variation in EFFR and SOFR, respectively, where in the case of SOFR we distinguish between end-of-month spikes and spikes at other dates. For EFFR, the variation due to the policy rate component clearly dominates and the residual noise component contributes very little. For SOFR, the single non-end-of-month spike in September 2019 represents a large outlier. The contribution of the end-of-month spikes and the residual noise are relatively larger than in the case of EFFR. However, the policy rate component represents a substantial part of the variation in both rates. Focusing on the most recent history, we see that we have not had any repeat of the September 2019 spike event and end-of-month spikes also seem to be disappearing, which might suggest that a policy rate component jumping at known dates, plus a diffusive spread to the target rate, might be the most appropriate model for SOFR dynamics going forward.

Figure 5: Contributions to SOFR variation in vertical order (i) target rates (iii) non-end-of-month spike (iii) end–of–month spike (iv) residual noise

Conclusion

As a rate reflecting transactions in the Treasury overnight repurchase market, the dynamics of SOFR are closely linked to the dynamics of EFFR, which is the interest rate most directly impacted by US monetary policy target rate decisions. Therefore, these rates feature jumps at known times (FOMC meeting dates), and market expectations of these jumps are reflected in prices for futures written on these rates. On the other hand, forward rates implied by Fed Funds and SOFR futures continue to evolve diffusively. The model presented in our paper reflects the key empirical features of SOFR dynamics and is calibrated to futures prices. In particular, the model reconciles diffusive forward rate dynamics with piecewise constant paths of the target short rate.

Professor Erik Schlögl is Director of the Quantitative Finance Research Centre and Karol Gellert is a PhD student at the University of Technology Sydney. Their full paper can be found here.